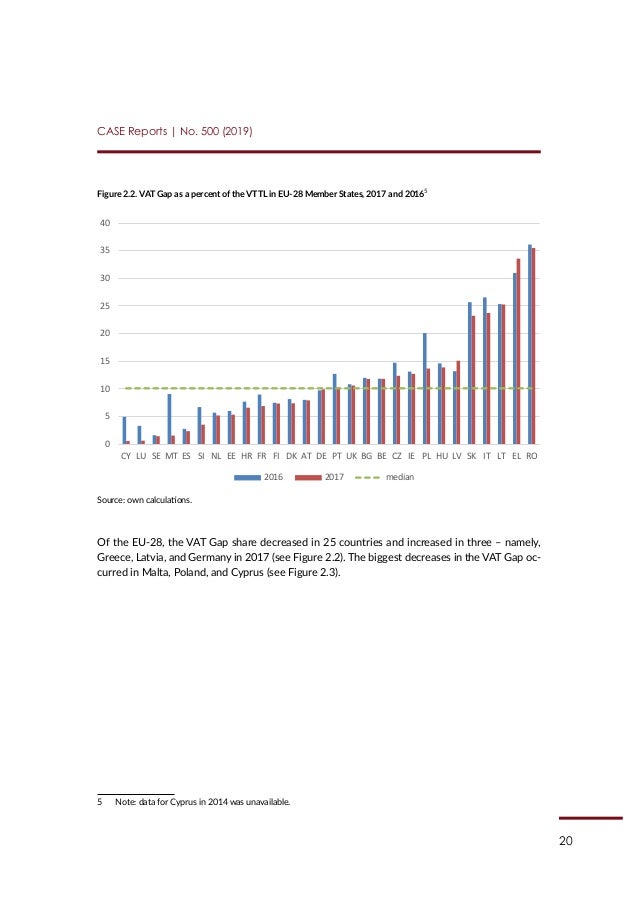

VAT non-compliance costs in Europe fell to €160 billion - CASE - Center for Social and Economic Research

Eugen Jurzyca on Twitter: "Before further #harmonisation of VAT rules it would be worth analysing the effectiveness of national antifraud VAT measures and exchange of best practices to know why some Member

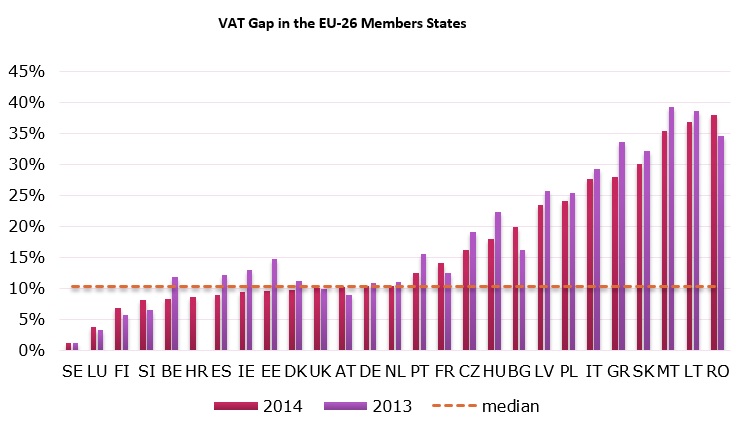

The VAT gap in the Central and Eastern European countries (as a percent... | Download Scientific Diagram

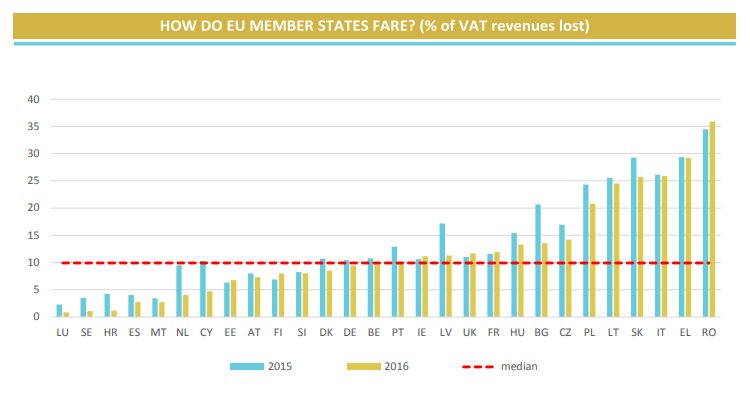

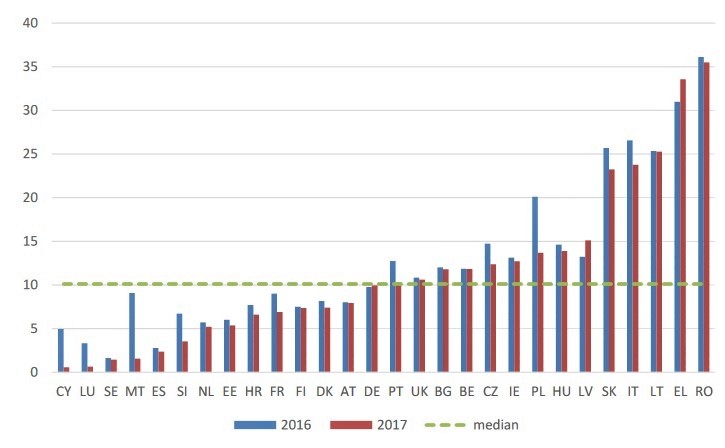

European Commission 🇪🇺 on Twitter: "EU countries lost almost €150 billion in #VAT revenues in 2016, according to our new study. They have been reducing this 'VAT Gap', but a substantial improvement

CASE REPORT: an 8 % increase in VAT revenue due to increased compliance, and a 6 % increase due to favourable economic climate - CASE - Center for Social and Economic Research