Before We Close Tax Gaps, We Have to Understand Them - CASE - Center for Social and Economic Research

https://t.co/a6dkL6jmm6… "" title="EU Tax & Customs 🇪🇺 on Twitter: "What is #VAT gap? FAQ on 2016 VAT Gap Study > https://t.co/a6dkL6jmm6… "">

https://t.co/a6dkL6jmm6… "" title="EU Tax & Customs 🇪🇺 on Twitter: "What is #VAT gap? FAQ on 2016 VAT Gap Study > https://t.co/a6dkL6jmm6… "" />

https://t.co/a6dkL6jmm6… "" title="EU Tax & Customs 🇪🇺 on Twitter: "What is #VAT gap? FAQ on 2016 VAT Gap Study > https://t.co/a6dkL6jmm6… "" />

https://t.co/a6dkL6jmm6… "" title="EU Tax & Customs 🇪🇺 on Twitter: "What is #VAT gap? FAQ on 2016 VAT Gap Study > https://t.co/a6dkL6jmm6… "" />

https://t.co/a6dkL6jmm6… "" title="EU Tax & Customs 🇪🇺 on Twitter: "What is #VAT gap? FAQ on 2016 VAT Gap Study > https://t.co/a6dkL6jmm6… "" />

EU Tax & Customs 🇪🇺 on Twitter: "What is #VAT gap? FAQ on 2016 VAT Gap Study > https://t.co/a6dkL6jmm6… "

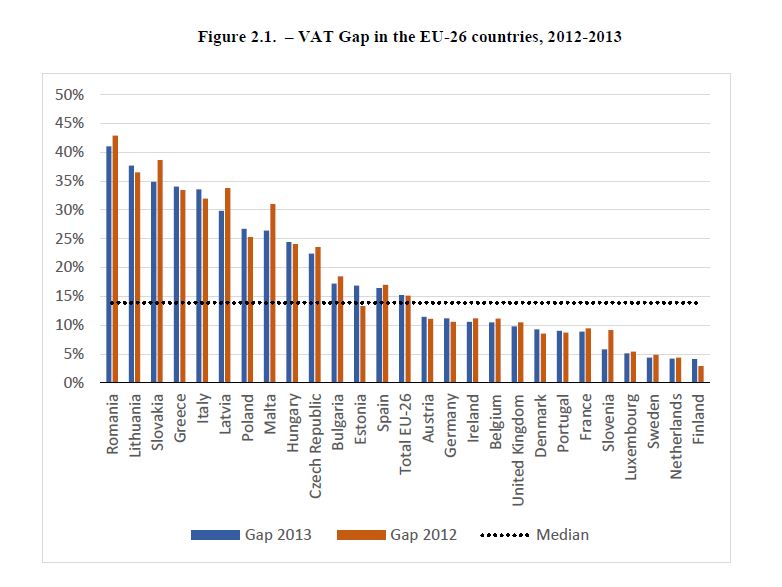

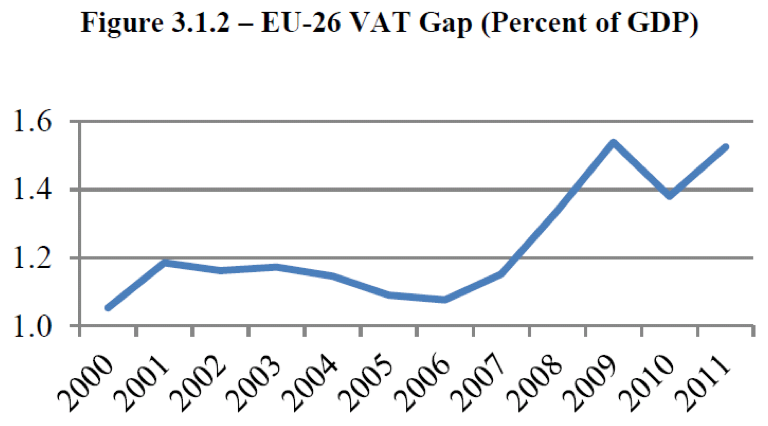

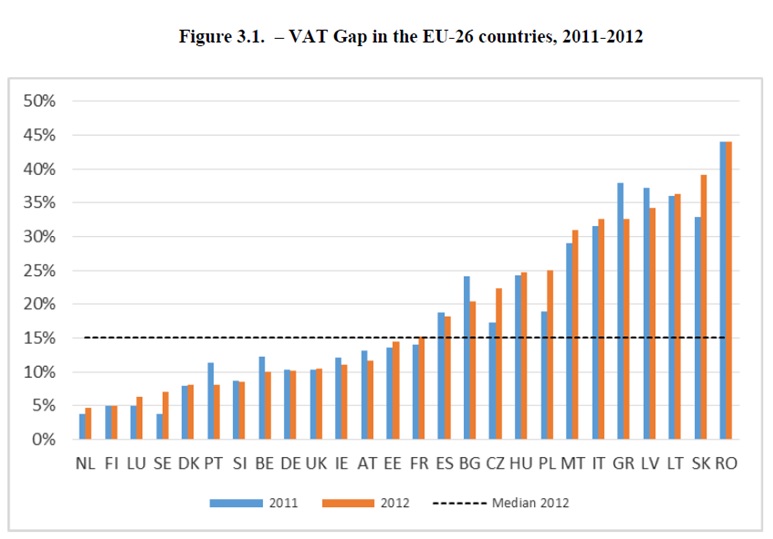

2012 Update Report to the Study to quantify and analyse the VAT Gap in the EU-27 Member States - CASE - Center for Social and Economic Research

The VAT gap in the Central and Eastern European countries (as a percent... | Download Scientific Diagram

![PDF] Asesssing the Impact of Value Added Tax (Vat) Gaps on Vat Revenue Generation in Nigeria | Semantic Scholar PDF] Asesssing the Impact of Value Added Tax (Vat) Gaps on Vat Revenue Generation in Nigeria | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/b5bacbdd070ac126d7cbd65cac08474302ca5488/9-Table1-1.png)